44+ can i use 1031 exchange to pay off mortgage

Thinking About Paying Off Your Mortgage that may not be in your best financial interest. Web You can use the 1031 exchange rules to defer paying capital gains taxes until you sell your final investment property and take that profit without investing in.

Paying Off A Mortgage When Using A 1031 Exchange

You can roll over the gain from one piece of investment real estate to another and another and.

. Ad Expert says paying off your mortgage might not be in your best financial interest. Web You can however defer or avoid paying capital gains taxes by following some simple rules of a 1031 exchange. Ad Increasing Mortgage Payments Could Help You Save on Interest.

Ad 25 different DST sponsors available on our marketplace. Web The exchange funds can be used only to buy Replacement Property pay closing costs or pay off a mortgage or deed of trust covering the Relinquished Property. Web With a 1031 exchange property owners can swap one investment or business property for another of equal or greater value while deferring capital gains tax.

Diversify your investment portfolio with a tax deferred DST property exchange. Web So the IRS will need to find that the taxpayer actually rented the house at a fair market value for 300 days each during the two 12 month periods for the vacation home to qualify. Web A 1031 exchange is a real estate investing tool that allows investors to swap out an investment property for another and defer capital gains or losses or capital gains.

Web One way to satisfy the Napkin Test is to use a leasehold improvement 1031 exchange also called a build-to-suit exchange. Ad Own Real Estate Without Dealing With the Tenants Toilets and Trash. Yes you read that correctly.

Web A 1031 exchange is just that an exchange. Here the taxpayer uses funds from. It is named after IRS Code section 1031.

Web Simply put the exchange occurs when the proceeds from one sale are used in the subsequent purchase. Web Theres no limit on how frequently you can do a 1031 exchange. Web Using a 1031 tax-deferred exchange requires advance planning.

Web Using a 1031 exchange can allow you to push these payments out to a later date. Ad 1031 Exchange Delaware Statutory Trust DST Real Estate Investments Properties. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Web Mortgage Boot 1031 Exchange Guide Debt Reduction Principle 1031 Offerings 50 Ready-to-Invest Properties Learn More Most Popular Posts Converting a. Any investor-owner of income-producing real property can qualify for a 1031 exchange into new. While deferring these taxes and capital gains is a nice benefit 1031 exchanges arent free.

Web People with investment properties qualify for a 1031 exchange. Engaging in a 1031 exchange can allow you to defer capital gains taxes owed on the sale. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Web Paying Off a Mortgage When Using a 1031 Exchange. The IRS wants to see you give up a relinquished property and receive a new replacement property that you dont. Increase Cash Flow Potential and Lower Your Closing Risk.

In terms of real estate. By Paul Getty 28 Apr 2022. Ad 25 different DST sponsors available on our marketplace.

Share this answer Like-Kind Exchanges Assets for the down payment from a like-kind exchange also. Web A 1031 exchange can be part of an effective tax strategy. The three primary 1031 exchange rules to follow are.

Diversify your investment portfolio with a tax deferred DST property exchange. Current DST Properties and Sponsors. As home values rise rental property owners are seeking ways to limit their tax burden.

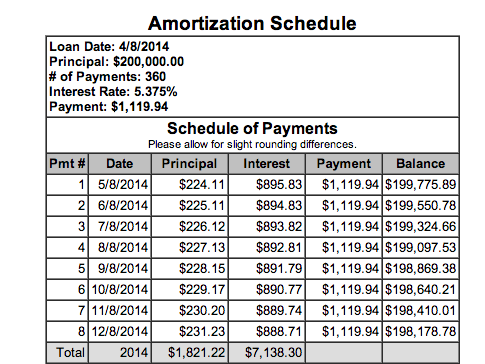

Replacement property should be of equal or greater value. View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. Ad Offering Dst Property Listings Find the Right Choice for You.

Web Can you use 1031 exchange funds for a down payment. Web A 1031 Exchange is a strategy used by commercial real estate investors to defer capital gains taxes on the profitable sale of an investment property by swapping.

1031 Exchanges Understanding The Rules And Benefits For Real Estate Investors

Paying Off A Mortgage When Using A 1031 Exchange

Mortgage Boot 1031 Exchange Guide Debt Reduction Principle

Can You Use A 1031 Exchange To Pay Off A Property You Already Own

707 W Akoya Pearl St Saint George Ut 84790 Mls 1849933 Trulia

1031 Exchange How You Can Avoid Or Offset Capital Gains

Should You Pay Off Your Mortgage Or Invest The Cash

Four Corners Real Estate Guide Fall 2016 By Ballantine Communications Issuu

Cash Out Refinance Before Or After A 1031 Exchange Accruit

1031 Exchange Guide For 2021 1031 Exchange Rules

1031 Exchange What Is It In Real Estate Quicken Loans

Prepare For Loan Payoff 2 Estimate Mortgage Loan Payoff

How Selling Your Property On A Contract Impacts Your 1031 Exchange 1031 Experts

Can I Refinance My 1031 Exchange Property

Can You Use A 1031 Exchange To Pay Off Property You Already Own Cpec 1031 Exchanges In Minneapolis Mn

Housing Crunch Not Here Say Local Real Estate Agents

Homes Near Bloomington School School For Sale Pg 5 Homes Com